While the healthcare IT (HCIT) industry has taken off in the last several years, it is now at a key inflection point. Spurred in part by the shift in the delivery world from a group of employers and organizations that are treated monolithically to a model that demands more consumer-specific solutions, as well as changes in reimbursement, the industry is more poised for broad IT adoption and scaled to grow at an unprecedented pace.

Organizations now find themselves in need of leaders with an often rare combination of skill-sets and experiences essential to leading operations of growing magnitude in an evolving environment. However, these executives are scarce in the HCIT space. Amid a rapidly changing, complex landscape, healthcare IT companies must confront the challenges of:

- where to find talent equipped for the dynamic sector,

- how to build the talent pipeline, and

- how to determine if talent will perform well without direct previous experience.

We spoke with several HCIT luminaries to gain their insights into where the industry is headed and how they think about talent and leadership in a transforming industry.

An Industry in Flux

Martin Coulter, CEO of Patients Like Me, shared that the recent push for transparency and accountability in healthcare from both consumers and the government has resulted in payors, providers and, to some extent, regulators beginning to adopt and experiment with technology and data in ways not seen before. “The overall market for healthcare technology is really shaped by two big influencers: One is the general market for technology,” said Neil de Crescenzo, CEO of Emdeon. “The healthcare market is not going to be immune to sea changes in technology, namely social, mobile, analytics and cloud. The second is the societal need to have healthcare work more as a system.” Industry veterans predict an influx of new startup companies. “Someone will come in and build the healthcare version of Open Table or Kayak,” commented Paul Black, CEO of Allscripts Healthcare Solutions.

As the industry becomes more mature, leaders also anticipate an evolution in how data is used. Neil Hunn, group vice president for Roper Industries posited, “I think the next evolution, now that data is being captured electronically, is what to do with the data? How do you help the entire ecosystem of payors, providers and patients enable more efficient, coordinated care at lower costs?”

“It’s more about data management than it is data gathering and that is a huge gulf in terms of skill-sets required in those business models,” echoed Andy Eckert, CEO of TriZetto, which was recently acquired by Cognizant. To seize opportunities of not just collecting, but using data to drive decisions in the space, Black predicts new startups with fresh perspectives will emerge around data analytics, “companies that can use and repurpose the data collected, that are not encumbered by 20 or 25 years’ worth of ‘here is the way it’s been done’ or ‘here’s the way I was taught to think.’”

These myriad changes will require new skill-sets; each of the leaders we spoke with identified the shortage of talent ready to lead in an increasingly consumer-driven industry as a key challenge going forward, as seen in the following figure.

Leadership qualities for a changing landscape

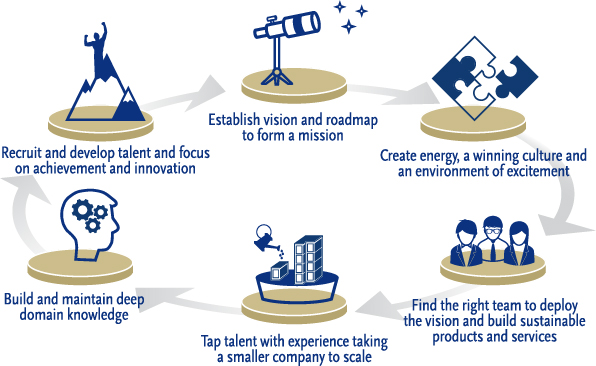

Building a world-class healthcare IT organization amid a classic industry shift, likened by Black as moving from mainframes to mini computers to PCs, requires top talent and performance at every level. However, today’s complex environment requires senior leaders with a particular set of skills and qualities needed to navigate this new landscape. Trace Devanny, president of the healthcare business of Nuance, said, “There is an extreme shortage of senior executive talent in this space with the necessary leadership, experience and technical knowledge required to lead today’s increasingly complex organizations and particularly, the organizations of the future.” Devanny views these intricate talent issues through the lens of a leadership life cycle. From energizing the organization to possessing domain knowledge, the industry requires leaders with the diverse skills and attributes necessary to navigate — and sustain — this cycle.

Pursuing nontraditional sources of senior leadership talent

The overall evolution in the industry demands a similar evolution of where companies look for talent. With a scarce supply of proven leaders, healthcare IT companies may need to turn to unconventional sources of talent.

Technology has given consumers access to unprecedented levels of information and, thus, more power than ever before in every purchase decision. Accustomed to superior service in retail, customers increasingly expect the healthcare industry to deliver the same convenience and seamless experiences provided by the Amazons and Nordstroms of the world. As a result, companies in the industry are realizing they need talent with consumer marketing skills. Organizations highly regarded for their customer service, such as Zappos, become more realistic sources of talent as the industry moves to a more consumer-driven orientation. Coulter anticipates an unprecedented influx of people with consumer experience backgrounds who can help create user-friendly technology solutions, such as elevating typically rudimentary patient portals to the level of today’s more sophisticated, intuitive apps that support your personal workflow needs.

Given its own transformation, the financial services sector has also become a go-to industry for healthcare IT companies to find talent. “We’ve had some success bringing people in from larger financial tech companies because they’ve gone through many of these same changes we’re seeing in the healthcare world,” said Eckert. “The progress the financial system has made in terms of interoperability, lower costs and efficiency for the consumer is pretty remarkable — and the healthcare system needs the same.”

Private equity could also prove a viable source of “smart, aggressive, young, hungry” executives, according to Black, who observed firsthand how one young star of a PE firm who, despite a short tenure consulting in healthcare IT, garnered the respect of CEOs throughout the industry largely by virtue of his intellect and relentless work ethic. In the increasing absence of direct industry expertise, HCIT organizations may benefit from pursuing similar individuals who possess high intelligence and an orientation for action — characteristics generally shared by executives who have successfully switched industries.

Demand will also grow for leaders who can examine and then reengineer processes as the industry continues to change. “You’re going to see a real demand for people with a systems understanding who can rethink how business processes can be taken apart and pieced back together,” said Coulter. “The industry will need talent who can reimagine how the healthcare world could function and create new operating models that drive value and efficiency.” To acquire these new perspectives, some companies have tapped talent from pure software, networking or payments companies. “I think one of the things that is most challenging, yet exciting about recruiting right now is the fact that you’re not really in competition with your competitors as an enterprise,” said de Crescenzo. “You’re only really competing with two types of companies: either a well-funded startup or fast-growing company in Silicon Valley or elsewhere, which has an energized board and management team, or a highly regarded, technologically advanced, scaled company like Google, Amazon or Netflix.”

Finding leaders with industry expertise

Depending on the specific role, industry expertise remains paramount for some. Often, companies do not have the luxury of a lengthy learning curve for new leaders to fully grasp the space’s nuances. “I think it’s very important to have industry experience,” added Coulter, “and an understanding of the market, a familiarity with the sector-specific concepts and language, and a network that can be readily accessed.” Many leaders feel this lack of specialized knowledge most acutely in the sales function, where there is a dearth of talent who can bridge sophisticated offerings with how they fulfill the needs of the provider, payor and patient.

Hunn agrees that for product management roles, you need a leader with domain knowledge, but for other roles focused on the mid- to long-term horizon, companies simply need the best athlete. He also believes that it can be more important for CEOs in the space to be strong builders of talent and operational excellence rather than star product managers.

Others worry that experience in a single type of healthcare-related company may not even be enough to drive a successful strategy amid growing complexity as individual exchanges are built out and disruptors enter the market. “You need to look at somebody who has had multiple different experiences,” said Black. “They didn’t just grow up in hospitals or a health plan or a clinic. I had a conversation recently with a leader and was awed at his level of understanding of where the market is moving and his strategy for getting from here to there. A lot of that perspective had to do with the fact that he came from a multispecialty clinic.”

Building the talent pipeline

Competition for such multitalented leaders is fierce, but the opportunity to work on innovative technology while making a difference can be a strong magnet. de Crescenzo has witnessed a surge in interest in entering the industry from talented outsiders. “We’ve seen a lot more people excited to enter the industry and I think that’s going to increase the pace of change, but it means that the organizations that have been in the industry need to realize they can’t operate at the same pace of innovation that they might have operated in the past,” he said. Eckert agreed, “The level of talent that has gravitated toward healthcare IT in the last decade versus the 90s is really night and day. We are seeing a lot of top-tier talent coming into the market. The passion around the business has really grown.”

In addition, strong organizational structures and governance practices signal that there is a solid foundation upon which leaders can succeed and grow. Devanny has also found that mentoring programs are valuable recruiting tools.

In light of the overall shortage of leaders ready to take the reins, organizations are looking to cultivate up-and-coming talent and are investing in development. Hunn says he is always looking two levels down the organization for the company’s future leaders. Nuance seeks talent at even earlier stages in their careers, recruiting top college graduates so that the company can instill its culture early on and ensure a fit on both sides.

However, the existence of a development program is not enough — it needs to be substantive and allow enough time to learn and deliver results. “In a lot of other organizations, there are training wheels on the general managers,” said Hunn. “They have a heavy corporate overlay or they are only a general manger in title, but not function. In our case, we’re really grooming true, fully rounded general managers who cover 95 percent of the functions that an independent CEO would.” While most GM training programs may rotate the executives after two years, Hunn argues that it takes longer for an executive to “season” and demonstrate results over a true product lifecycle.

Prioritizing assessment

In a space as varied as healthcare IT where the “traditional” leadership profile is outdated for today’s needs, assessment of talent becomes even more important. Understanding how these leaders will succeed in highly dynamic, high-growth organizations is important as companies cannot afford to make a misstep on key hires. In such a purpose-driven industry, the majority of companies place heavy weight on a candidate’s fit with the culture. However, it is important to note that even in an organization defined by its mission, culture can be fluid. For example, while Coulter prizes collaboration skills in potential leaders, he acknowledges that as the organization continues to grow and becomes more business-focused, he may have to bring in and leverage selected counter-cultural talent.

How Can Your Board Help?

In an industry as diverse as healthcare IT, it is no surprise that leaders lean on their boards in varying degrees to help navigate talent issues. The leaders we spoke with felt that recruiting is the responsibility of the entire organization, and a process that can also benefit from the board’s perspective. Here are some ways HCIT companies view their board’s role in talent strategy:

As a Partner

Private equity-funded ventures tend to partner heavily with boards, with some playing an instrumental role in building management teams. de Crescenzo considers Sandy Ogg, partner with Blackstone (which is a lead investor in Emdeon), a true partner in determining an optimal talent strategy. In fact, Blackstone’s board members and partners help interview and sell the opportunity to leadership candidates for Emdeon.

As an Adviser

If directors have significant business expertise, company leaders draw from that deep experience to help them think about organizational improvement and talent issues.

As a Sounding Board

Some take a more hands-off approach, with the CHRO checking in with the board annually to review the talent strategy.

Determining whether a candidate is a good cultural fit requires a substantial commitment of time and resources. “There’s really no substitute for spending significant time with candidates, especially if they’re coming from outside the industry,” said de Crescenzo. Candidates meet with a large number of leaders throughout Emdeon, who assess their alignment with the company’s five core values while familiarizing them with the culture. After learning the hard way that a poor fit is not always revealed during the interview process, de Crescenzo conducts quarterly reviews of new senior leaders and uses a data-driven approach, championed by the Blackstone Group, to determine if they are accomplishing their objectives.

Roper Industries employs a Socratic method to assess culture fit, opting for long conversations with candidates to draw out answers to key questions: Are they data-driven? What is their communication style? Do they lead or have to be led?

Experts also emphasize screening leaders for their potential to deliver results. The stage of the business can inform how well a leader will fit. Those coming from a growth-focused business may not be well-suited for a shift to a more mature company and vice versa. In an industry where so few executives have taken a small company to scale, Devanny evaluates whether an executive’s previous experience shows he or she has the potential to manage growth and scalability, as well as technology and healthcare knowledge. Eckert also assesses senior executive candidates based on their track records of performance and advancement at large organizations.

Looking ahead

Healthcare IT industry leaders fully expect the continued blurring of lines as organizations seize new opportunities to manage care across the continuum. Consumers will drive even greater demand for accountability, transparency and more efficient care. More consumer-focused innovations are not far-off “what-ifs,” but imminent possibilities. In order to fulfill their missions and compete in the market, HCIT companies will need to adjust to a rapid pace of innovation. Many will need to shed the old paradigm of decades-long product testing and deployment; de Crescenzo believes that companies that historically moved at “x” speed will soon need to move at “3x.” Succeeding at a heightened pace amid ambiguity may mean that industry leaders have to take a risk on mold-breaking talent, but they also stand to reap significant rewards.