The value of diversity is well-recognized today. Studies have found that greater gender diversity can help organizations be more innovative1 and higher performing. A recent Credit Suisse report2, for example, found that companies where women made up at least 15 percent of senior managers had more than 50 percent higher profitability than those where female representation was less than 10 percent. Yet study after study finds that the pipeline of women narrows at each successive level of most organizations. While we see milestones in the number of women in corporate boardrooms and C-suites, most would agree that women’s progress into senior business leadership roles remains mixed.

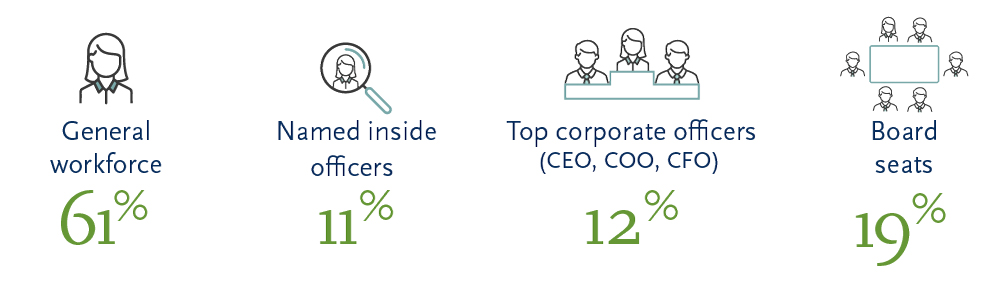

McKinsey’s 2018 Women in the Workplace study found that, among companies of all industries, women constitute nearly 48 percent of the entry-level workforce, but only 23 percent of C-suite roles. The insurance industry is not immune to this challenge. Insurance companies have a larger percentage of women in the general workforce — more than 60 percent3 — but comparatively fewer in top leadership. Just 11 percent of insurance companies’ named inside officers and 12 percent of top corporate officers are women4.

Disappearing women: the female talent pipeline in insurance

Sources: U.S. Bureau of Labor Statistics, Current Population Survey, 2016. Saint Joseph’s University Study on Insurance Industry Demographics, 2013, 2015, 2017.

How can women in insurance get beyond those traditional drop-off points and move further along the funnel and into top leadership roles?

Valuable lessons, we thought, might be found in the stories of women who, during the past 25 years, have built successful careers in the insurance industry. We had in-depth discussions with senior women leaders in the sector about the key turning points in their careers and the potential lessons from their experience — for companies and women themselves — so we can better understand how to increase the diversity of insurance leadership.

Women losing ground in average pay

* Bureau of Labor Statistics

Career turning points: access, experience and broader perspectives

Kathleen Savio, chief executive officer of Zurich North America, has had many opportunities to try new things over her dozen or so roles within the company. But a key turning point for her came when she was tapped to work first as chief of staff to the Zurich North America CEO and, ultimately, as the chief administrative officer of the company.

“The reason that was pivotal was that it gave me a priceless vantage point on the business across North America and insight into the broader group topics as well,” Savio said. “As the right-hand person to the CEO, you gain a lot of perspective on the kinds of discussions a CEO is involved in, the team dynamics, the language of the top roles — and what the CEO sees, hears and deals with, how to prioritize and sustain energy.”

A key turning point for Fran O’Brien, now a senior vice president for Chubb Group and division president of North America Personal Risk Services, came when she was asked by the head of the personal insurance department to be the product manager for a new product. The new role took her out of the actuarial department and into underwriting. The visibility of the new role turned out to be a game changer for her career, which led to positions such as chief underwriting officer, chief risk officer and eventually a P&L role.

“I immediately had a much more visible position in the product management role, and I also had the opportunity to work with executives at the group level, with people like the general counsel, chief claims officer and the chief information officer,” she said. “That allowed me to create a broader network and to prove that, if a senior executive at Chubb was putting a team together, they would (or should) want Fran O'Brien to be on their team. I always wanted people to say, ‘If I had to get something done, she's somebody I would want to work with me because she's a problem solver and I can trust her.’"

A role providing access and visibility to senior leadership was also a turning point for Sharon Fernandez, president of business insurance for Farmers Insurance. In her late 20s as a manager in an operational area at USAA, a colleague encouraged her to apply for an analyst job in a corporate function. Fairly new to her role, Fernandez assumed that she didn’t have enough experience for the role and was unlikely to get it. “A female peer came to me and said, ‘You need to apply for this job.’ She pushed me to apply for that job. I did, and I got it,” Fernandez said. “That gave me access to work on all kinds of projects, to get to know the senior executives at USAA, which was critical. If people don't know who you are, you don't get the opportunities like somebody that they know. That access made a huge difference.”

The role of sponsors and willingness to take risks is another theme. Earlier in her career in investor relations at Zurich Insurance, Seraina Macia, now executive vice president and CEO of AIG’s Blackboard Insurance, was on maternity leave with her second child when she received a call from a senior leader asking if she would be interested in moving to the U.S. to serve as the CFO of the Specialties business unit. “When you’re out on maternity leave, you feel like you’re out of sight, out of mind, but that didn’t happen to me. I took that opportunity and moved to the U.S. with a three-year-old and a six-month-old,” Macia recalls. “What defines my career, in a way, is that I have been fortunate enough to have opportunities and sponsors, but I also was courageous enough to take opportunities when they came.”

Similarly, Rebecca Tadikonda, who heads MetLife’s Strategic Growth Markets, Asia, recalls an assignment in Australia early in her career at Bain & Company as a milestone for its accelerated development opportunities. "There was more business than the company could staff, and I got put into bigger roles that pushed me and provided a lot of opportunities and a very accelerated learning path."

Given the pull of unconscious bias and the tendency of many women to keep their heads down and focused on the work, companies are unlikely to make significant progress increasing gender diversity absent a systematic approach to identifying and developing high-potential women

Building the leadership pipeline: what the insurance industry can do

There were few role models or well-worn paths to the top for women to follow when these executives entered the industry. However, by examining their careers, a few common themes about how to increase the pipeline of women leaders emerge. Turning-point roles increased individuals’ knowledge of the business, provided the opportunity to work across disciplines, and increased their access to and visibility with the top leaders of the company. Success in these roles often led to new or larger P&L opportunities.

“That transition to a market-facing P&L role, where it’s less about influence management, and more direct responsibility for leading people and strategy and operational priorities was hugely beneficial for me,” Savio recalls. “It was a very big career shift and, in some ways, not the path I expected to take.”

Given the pull of unconscious bias and the tendency of many women to keep their heads down and focused on the work, companies are unlikely to make significant progress increasing gender diversity absent a systematic approach to identifying and developing high-potential women. This includes promoting women into the kinds of roles that give them broad-based exposure to the business and the opportunity to take on P&L responsibility. How might insurance companies do this?

Signal the importance of gender diversity from the top

Evidence shows that increasing diversity requires clear and consistent support from the CEO and senior management, and male leaders generally. Executive leadership sets the tone at the top that diversity is a priority and sets expectations that succession plans and candidate slates will include women. “To me that's the critical one. I’ve seen that if you pay attention and you set the right tone at the top, it will make a difference. You will see it,” Macia said.

Recognize, promote and reward leaders who sponsor and develop women

Affinity groups, mentorship programs and the like can only go so far in advancing gender diversity. All of the women we interviewed noted the importance of sponsors to their career advancement. Because the desire to hire someone with similar backgrounds and perspectives is so powerful, the pipeline of women in leadership is unlikely to expand much without a formal process for spotting talented women early and articulating specific development plans for them. Truly increasing opportunities for women requires the active participation of male leaders, including setting expectations that they will identify high-potential women and commit to their development, and rewarding those who do.

At Zurich, diversity plays an important role in succession planning. The organization provides the tools and support leaders need to ensure thoughtful and intentional consideration of diversity in their pipeline.

In certain instances, to increase the number of women in the leadership funnel, succession planning may need to look further out — not just two or three years out but five to six years — and reach into lower levels of the organization to identify high-performing women, said Savio. “Once you identify those people, then actually invest in their development and visibility and experiences.”

Avoiding making assumptions about women’s aspirations and interests and setting the expectation that leaders should reach out to people with diverse backgrounds also could help. "Don't just pick the people who are asking,” Fernandez said. “When leaders see women or people representing other kinds of diversity who could be qualified for a job, they should ask them to apply and encourage them to apply. That alone would make a huge difference.”

Foster an environment that welcomes diverse perspectives

Recognizing our biases and encouraging leaders to be thoughtful about bringing diverse perspectives to their teams is a start. It’s also important to celebrate leaders who build diverse teams, because it's hard to manage people who are different than you and it can take more time.

As more diverse perspectives are added to the team, it’s important to create a safe environment where different people can express their points of view, said O’Brien. “What I keep saying to everybody is there's no way for us to really evolve if we're all thinking alike. The ability to have different ideas out on the table and different perspectives is something that I really focus on, and I spend a lot of time gathering different perspectives. I talk to my team about creating an open environment that’s a safe place for people to debate and disagree, but then come together.”

Aspiring to the C-suite: advice for women in insurance

The leaders we interviewed came to the insurance industry for different reasons, but many were attracted to its intellectual challenges and focus on data, viewing the sector as a meritocracy, where their accomplishments would be recognized and rewarded.

How did these leaders get to the top? Hard work, of course, but also personal drive, supportive sponsors and co-workers, and the willingness to take risks with their careers. Here is their advice.

Speak up about your interests and aspirations. Even for leaders at the most senior levels of an organization, others may make assumptions about your interests and aspirations if you don’t articulate what you want. Fernandez recalls a situation when a senior leader assumed she wasn’t interested in a position. “Kind of in passing, he said, ‘Well, I know you don't want to do the job.’ Normally, I might have been more passive and said, ‘I'll do whatever you guys want me to do.’ But I said, ‘No, I'd really like to do it.’ I could tell the person was surprised. ‘You would?’ ‘Yes, I would like to take this job,’” she recalls. “They needed me to tell them that I wanted it. They weren't going to come and ask me.”

For this reason, women shouldn’t assume people in the company, even your manager, know the next move you want to make or where you see your career going over the long term. Communicate the value that you bring to the organization and learn how to advocate for yourself in a way that you're comfortable with.

“I’m a big believer in telling people what you want to do and how you feel. We think that everybody knows us, knows what we’re thinking and how we’re feeling, but they really don’t,” said O’Brien. “You have to keep reminding people, not as a nag, but in a productive way when you have your development discussions or projects come up that you might want to raise your hand for.”

Savio recommends making your aspirations and interests known beyond your manager, to as many people as possible. “It's not necessarily just communicating the specific role you want — I want to become a senior vice president — but what are you interested in? What do you like to do? What are you willing to do? Do you have mobility? Are you willing to take certain lateral roles because you love to learn?” she says.

Don’t feel ready. It’s been well-reported that women tend to think they need to meet all the qualifications for a position to apply for a role, and often need a nudge from a sponsor or co-worker to consider applying for a new job. The women we interviewed all recall a time when they made a leap into a new role and learned that they could “figure it out” and succeed.

“You don't have to be 100 percent ready. If you've got enough of a foundation and a little bit of support in the organization and you're willing to roll up your sleeves, go for it.”

Macia learned a valuable lesson early in her career about readiness after turning down a job heading a department, only to see the position go to someone less qualified. “I was pregnant at the time. I wasn’t sure I was up to the task of running the department. So I turned it down, and they hired somebody else,” she said. “They ended up having to fire the person. When the opportunity came around the second time, I jumped on it.”

Added Savio, “You don't have to be 100 percent ready. If you've got enough of a foundation and a little bit of support in the organization and you're willing to roll up your sleeves, go for it.”

Continue expanding your knowledge. It’s important to have a lot of clarity about where you want your career to go and understand the potential tradeoffs, and potentially make adjustments as your career evolves, Fernandez says. “You also have to keep yourself relevant, so regularly train and make sure you’re educating yourself on new things, whether it's in insurance or technology or just the world in general. By continuing to challenge yourself and learning different things, you’ll not only make yourself more valuable to your organization, you’ll be better prepared for those new opportunities that are likely to arise.”

Build relationships. Like many women, Tadikonda remembers being put off by the politics of corporate life earlier in her career. Over time, she reframed her thinking and started to view "politics" in terms of the human dynamic in business. "Building relationships is a skill to be learned like any other. I learned that you can be yourself and build relationships and integrate who you are outside of work and inside of work."

It can be a challenge for women to develop relationships in the same way that men do, as women may not get invited to social activities such as golf or even the fantasy football league. Nevertheless, helping others, tapping into external networks and finding authentic ways to build relationships with people across the organization is critical. “There have been a number of people during my career who went out of their way to give me advice, to help me out in certain situations, connect me with other people,” said O’Brien. “Make sure you do that. You get as much by being proactive in helping someone else. You'll get more out of that than you think because that person is going to change your perspective.”

Snapshot: women in insurance leadership

We looked at the top management teams of 29 insurance companies — 16 property and casualty (P&C) insurers and 13 life insurers. Overall, 18 percent of the 499 most senior executives at those companies are women, or roughly three women per company. The percentage of female executives is higher in life insurance companies (20 percent) than P&C companies (16 percent).

At three of the 29 companies, all in life insurance, women make up more than 25 percent of the executives

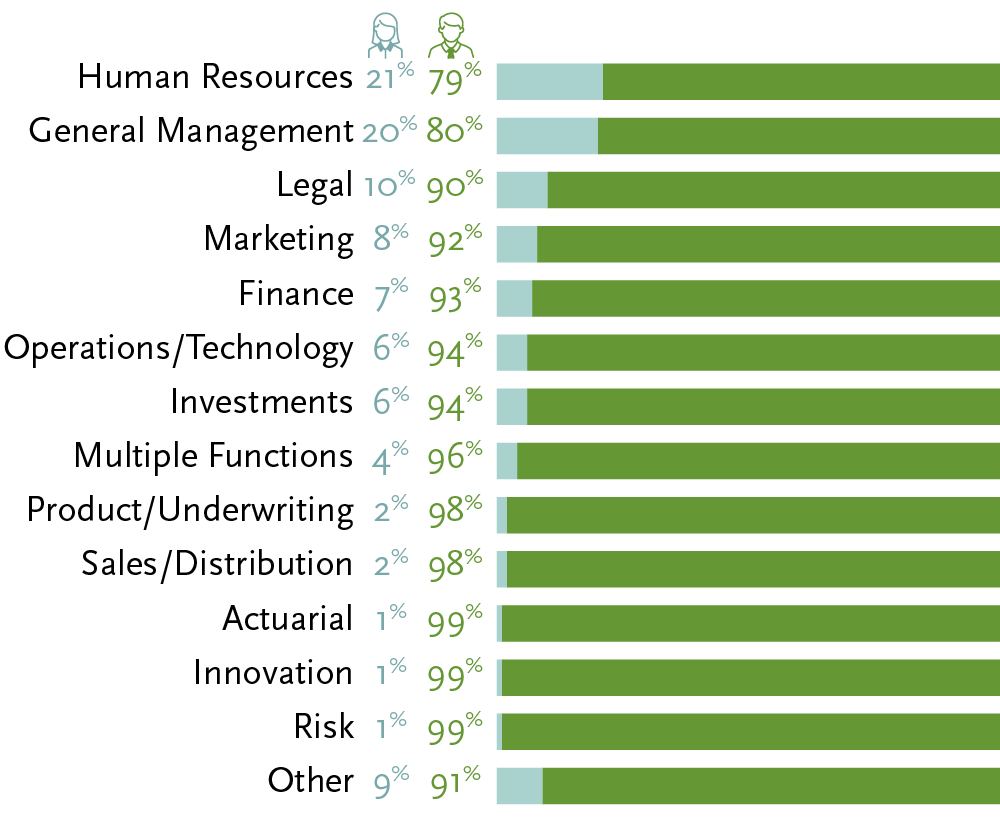

Women in leadership: The functional roles of women in executive leadership

Technical backgrounds

56% of the women in top general management roles have a technical background, compared with 40% of all women in all top management roles.

Technical discipline of female GMs

| |

Underwriting

|

40%

|

| |

Accounting

|

20%

|

| |

Actuarial

|

20%

|

Source: Spencer Stuart research

Conclusion

How can insurance companies increase the number of women in senior leadership roles? The careers of top women executives in insurance demonstrate the importance of ensuring women move into “turning point” roles that increase their knowledge of the business, provide opportunities to work across disciplines, and increase their access to and visibility with the top leaders of the company. Success in these positions often opens the door to new or larger P&L roles, which are a critical training ground for senior general management positions.

Companies are unlikely to make significant progress moving women into these key roles or increasing gender diversity in leadership without a thoughtful and systematic approach to identifying and developing high-potential women. The most effective organizations signal the importance of gender diversity from the top; recognize and reward leaders who sponsor and develop women; and foster an inclusive environment that encourages the participation of everyone.

1"Does Female Representation in Top Management Improve Firm Performance? A Panel Data Investigation." Cristian L. Dezső and David Gaddis Ross. Strategic Management Journal. September 2012. https://www0.gsb.columbia.edu/mygsb/faculty/research/pubfiles/3063/female_representation.pdf

2The CS Gender 3000: The Reward for Change. Credit Suisse. September 2016. credit-suisse.com/media/assets/corporate/docs/about-us/research/publications/csri-gender-3000.pdf

3Source: U.S. Bureau of Labor Statistics, Current Population Survey, 2016. http://www.bls.gov/cps/cpsaat11.htm

4Source: Saint Joseph’s University Academy of Risk Management & Insurance, Saint Joseph’s University Study on Insurance Industry Demographics, 2013, 2015, 2017