One of the main questions our clients ask when recruiting a CFO is whether the candidates should have previous experience in the role and in their industry. Different CFOs have taken different paths to reach the top, so there is no one “right way” to get there. But if we look at the data, we find there are patterns in the backgrounds of today’s CFOs. To answer our clients' concerns, Spencer Stuart has analyzed the backgrounds and demographics of the CFOs of the largest and most influential companies in the U.S., Europe and Russia over the past 10 years.

This is the first time we have studied the CFO route for executives in Latin America, and we now have a deeper understanding of what has prepared Latin American CFOs for the leadership positions they occupy. This report examines CFOs of top companies in Chile — specifically, the 40 companies that make up the Indice de Precio Selectivo de Acciones (IPSA) — and compares this data with that from other countries (In this study, “Latin America” refers to Argentina, Brazil, Colombia, Mexico and Perú). We pay particular attention to CFOs’ functional experience, their academic background and the difference in profiles between internal and external hires.

Executive summary

- Gender: 97% men/3% women

- Average age: 47 years old

- Country of origin: 78% of Chilean CFOs are local

- Average tenure: 7,7 years

- Internal vs. external: 69% were promoted from within

- Previous experience: 33% of current CFOs had previously worked as CFO

Diversity remains an opportunity

Gender diversity among CFOs in Latin America is low, and Chile has one of the lowest female representations: At the time of the study, only one woman was serving as a CFO of an IPSA-listed company — 3% of the CFOs in IPSA companies. By comparison, here is the percentage of female CFOs for other regions:

- Fortune 500 companies: 13%

- Latin American countries: 8%

- European countries: 6%

While Latin American gender diversity is low, this trend should change over the next several years as our clients are increasingly focusing on female talent when hiring.

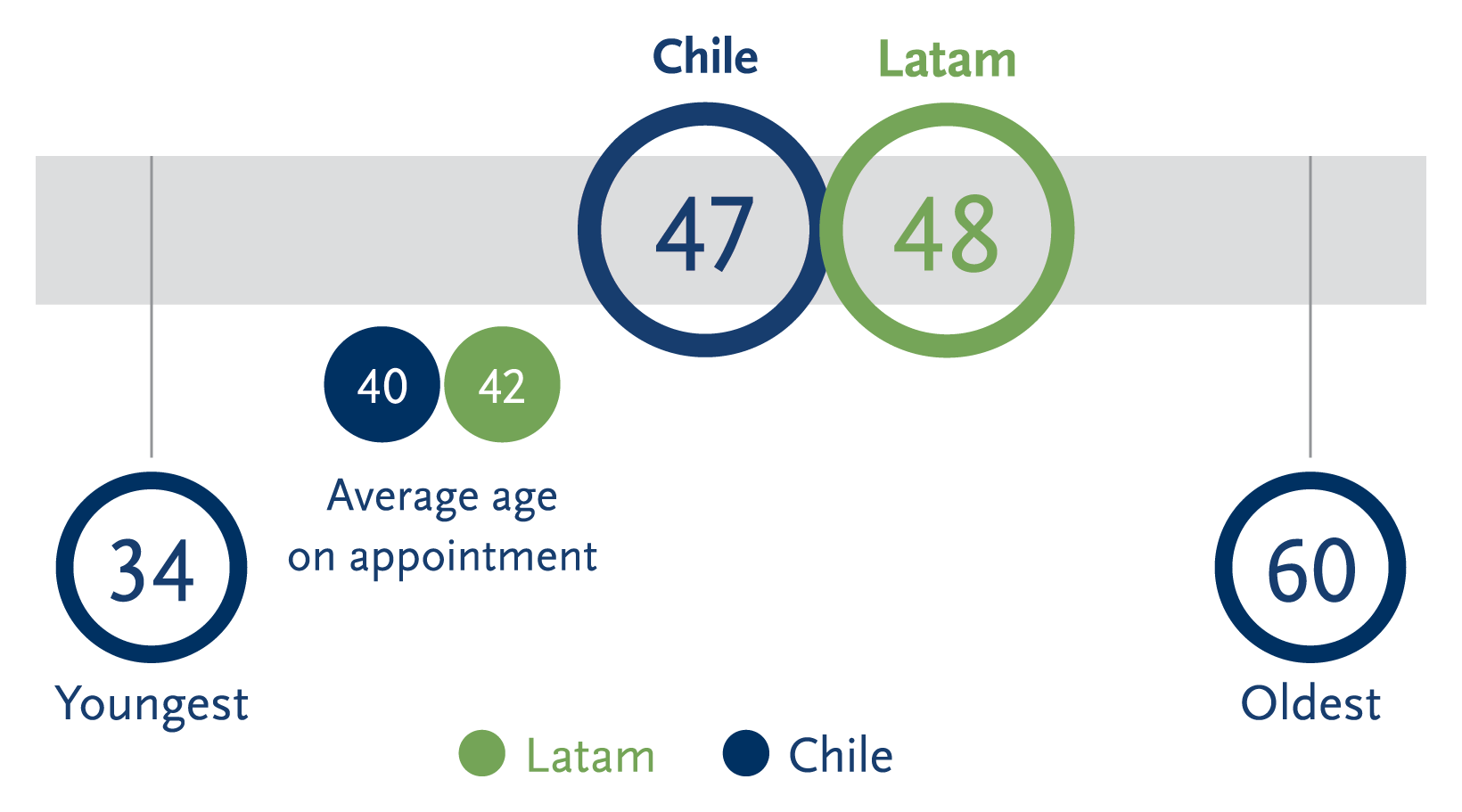

CFOs in Chile are younger than international averages

The average age for CFOs in Chile is 47, just below the Latin American average of 48. In Chile, CFOs were around 40 years old when appointed to their current position, two years younger than the Latin American average. By contrast, European companies tend to hire their CFOs in their mid 40s. For Fortune 500 companies, the average age of the new CFO in the class of 2016 was 51, up from 46 for the class of 2006.

Internal hires have a longer tenure

CFOs in Chile have an average tenure of 7,7 years, and internally appointed CFOs serve in their jobs for nearly two years longer than their externally hired counterparts. The average tenure for Latin American CFOs is 6,3 years, followed by the U.S. at 5,7 years and the U.K. with 4,9 years.

Nearly 80% of CFOs are from Chile

Seventy-eight percent of all CFOs are Chilean-born. By comparison, 86% of Latin American CFOs and almost 90% of European CFOs are local. While Chile has the highest percentage of foreign CFOs, a deeper look into the data finds that the local companies have local CFOs: Seven of the eight foreign executives in the IPSA have moved with their multinational companies to take the Chile CFO position.

More than 2/3 of CFOs are internal appointments

IPSA companies show a preference for internal candidates when appointing a new CFO: 71% of all CFOs were internally appointed, which is in line with what we see among Latin American (68%) and Fortune 500 (69%)companies. Internal appointments are more common in companies that have large finance departments with more development opportunities, resulting in a greater number of credible internal candidates for the top finance role.

Previous experience varies widely

Overall, 33% of all IPSA CFOs had previous experience in the role, which is similar to the percentage of Fortune 500 CFOs (31%) with previous experience. If we focus only on IPSA external hires, however, 60% had previous CFO experience. By comparison, 74% of Fortune 500 externally hired CFOs and just under half of European CFOs have previous experience.

In Chile, 70% of all external hires come from a different industry than their current employer, which is the same percentage as in Latin American countries. However, this figure differs greatly from the Fortune 500, where only 14% of CFOs come from a different industry. This dichotomy reflects the vast difference between Chile and the U.S. in the number of companies within each industry.

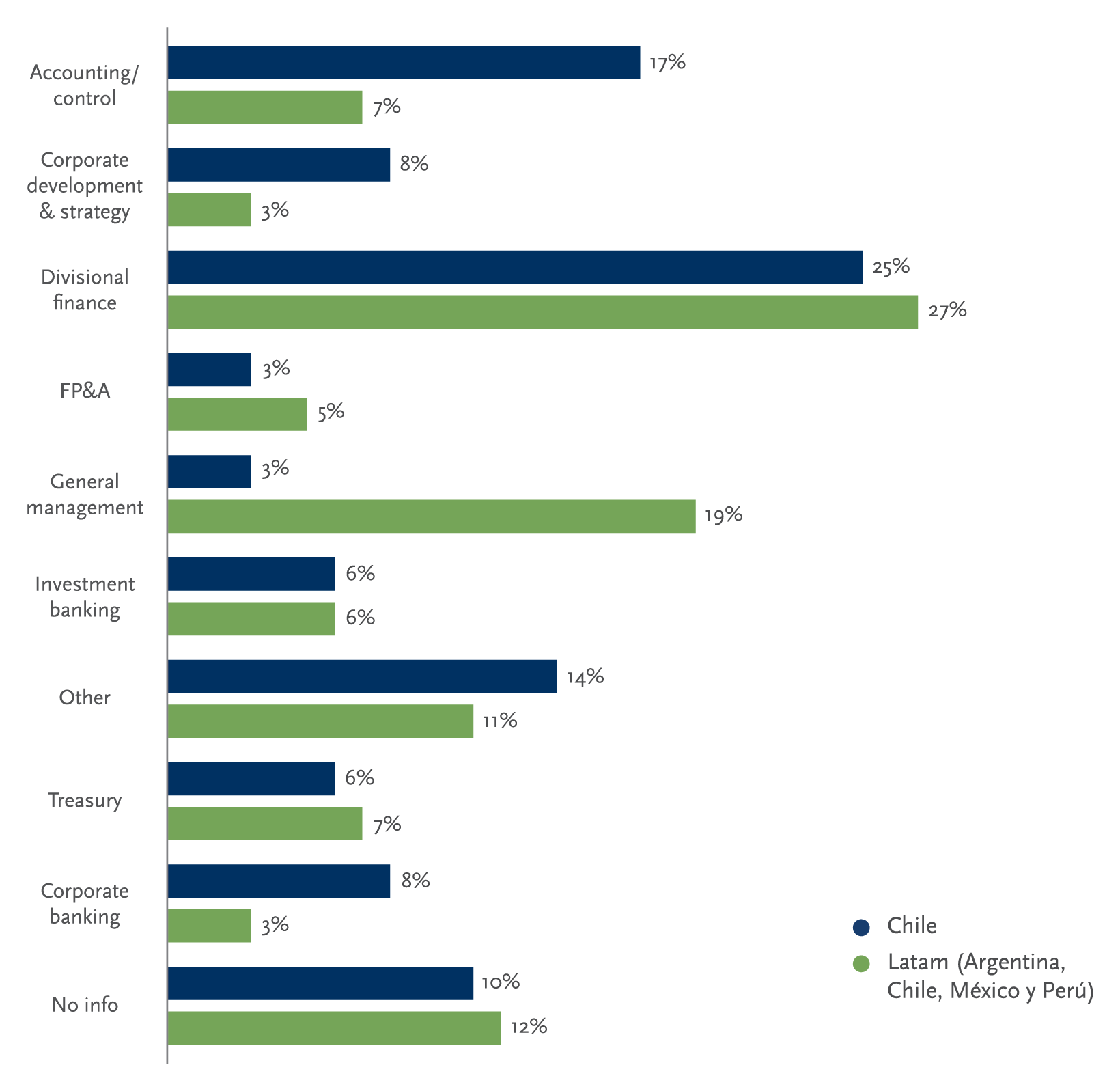

The CFO route to the top largely goes through finance

The route to the top represents the function or discipline in which the CFOs spent the most time in their careers before assuming their current role. The most common primary routes to the CFO role in Chile are divisional finance (25%) and accounting/control (17%). The CFOs’ level of previous experience varied, depending on whether they were internal appointments or external hires. As in Chile, the most frequent route to the CFO position in Latin America* is divisional finance with 31%, while the second-most frequent route is investment banking (10%). The remaining CFOs come from areas such as accounting/control, treasury, planning and financial analysis. Twenty-one percent of Chilean CFOs come from areas not related to finance.

CFOs in the United States and Europe also largely have backgrounds in the financial and control functions.

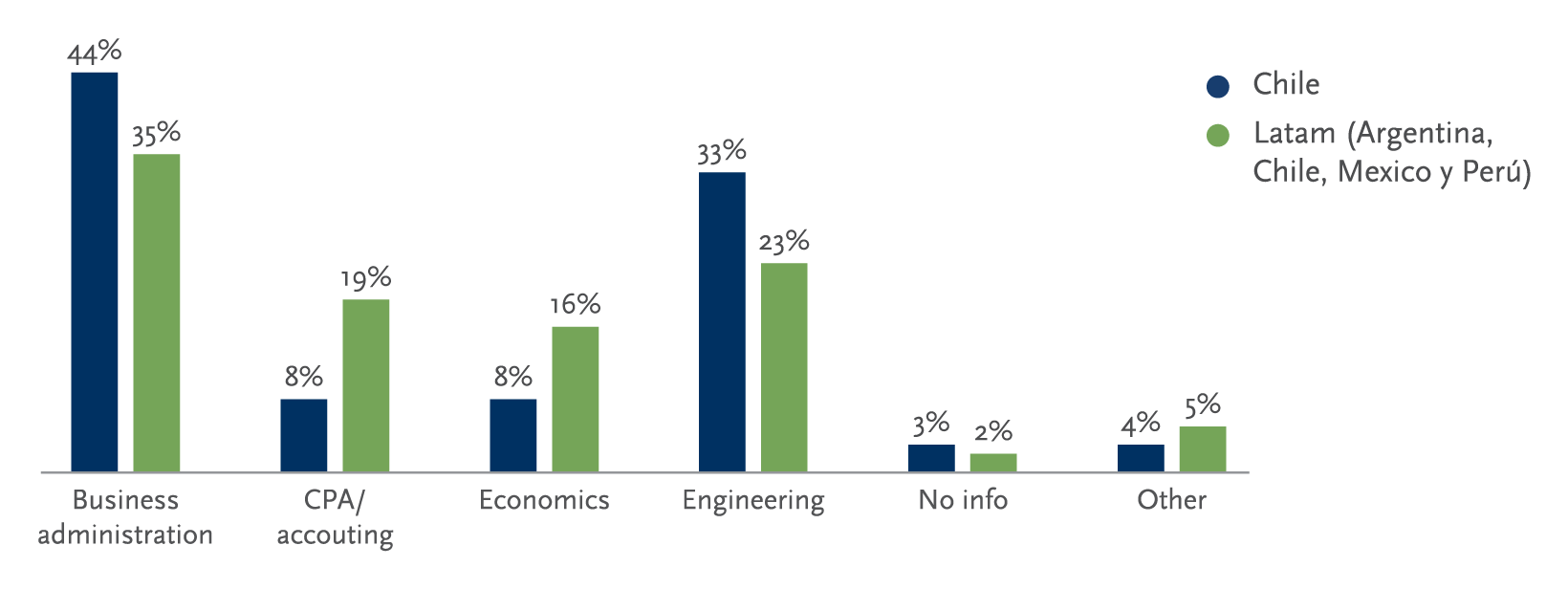

Most CFOs have a post-graduate degree

Broken down by major, 44% of CFOs in Chile studied business administration and 33% majored in engineering. This aligns with Latin American trends except for Argentina and Mexico, where there is a higher concentration of executives with an accounting background.

In Chile, the majority of the CFOs (61%) obtained their undergraduate degree from Pontificia Universidad Católica de Chile and Universidad de Chile. More than half (56%) of all IPSA CFOs have a post-graduate degree, largely MBAs.

Eighty percent of these executives went to college abroad — within that group, 57% studied in the United States and 43% studied in Europe. Those who received a post-graduate degree in Chile mainly attended Pontificia Universidad Católica de Chile or Universidad Adolfo Ibáñez.

| Academic background |

Argentina |

Brasil |

Chile |

Colombia |

México |

Perú |

Latam |

| Accounting (CPA) |

45%

|

12%

|

8%

|

10%

|

29%

|

12%

|

19%

|

| Business administration |

35%

|

34%

|

44%

|

35%

|

17%

|

47%

|

35%

|

| Engineering (civil, industrial, systems, etc) |

5%

|

23%

|

33%

|

30%

|

27%

|

18%

|

23%

|

| Economics |

10%

|

20%

|

8%

|

15%

|

16%

|

23%

|

15%

|

| Other |

5%

|

7%

|

4%

|

10%

|

4%

|

0%

|

5%

|

| No information |

0%

|

5%

|

3%

|

0%

|

6%

|

0%

|

2%

|

Methodology

For this report, Spencer Stuart conducted research in 2018 into the background and career trajectory of 592 CFOs who serve the top companies in six leading indexes:

- Argentina: Merval (25 companies)

- Brazil: Bolsa, Mais, Mais-Nivel 2, Nivel 1, Nivel 2 and Novo Mercado (373 companies)

- Chile: IPSA (40 companies)

- Colombia: Colcap (20 companies)

- México: México IPC (116 companies)

- Perú: Perú Select (17 companies)

This study is the first detailed analysis of the career path of each Latin American CFO, their academic and professional experience, hiring background, nationality, gender and tenure, among other variables.

Our research goes beyond public information; rather, we have studied each individual's background since the beginning of their careers. This has enabled us to identify patterns and determine which experience is relevant for potential CFOs.

This study concentrates on career histories prior to being appointed CFO for the companies that are part of the Chile Índice de Precio Selectivo de Acciones Index (IPSA), the main stock exchange index of Chile. For the first quarter of 2018, this index was composed of the 40 most-traded companies.

Merval is the main index of the Buenos Aires Stock Exchange. The selection criteria for these stocks is based on the volume traded and the number of transactions in the last six months. The rebalancing of the Merval is done quarterly.

B3 - Bovespa Mais, Bovespa Mais Nivel 2, Novo Mercado, Nivel 2 and Nivel 1 were created in order to develop the Brazilian capital market. To make this index, it was necessary to have segments suitable for the different company profiles. All of these segments are valued by differentiated corporate governance rules. These rules correspond to the companies’ obligations under Brazilian corporate law and are intended to improve the evaluation of those that voluntarily join one of these listing segments.

Colombia COLCAP Index includes the 25 most liquid stocks listed in the Bolsa de Valores de Colombia (BVC).

The S&P/BMV índice de Precios y Cotizaciones (IPC) seeks to measure the performance of the largest and most liquid stocks listed on the Bolsa Mexicana de Valores. The index is designed to provide a broad, representative, yet easily replicable index covering the Mexican equities market.

Peru Select Index is designed to measure the performance of the largest and most liquid stocks listed in the Lima Stock Exchange (Bolsa de Valores de Lima S.A. or BVL).

To view the list of Chile IPSA companies, download the full report.