2.1 Composition and appointment

Board composition is at the heart of board effectiveness. Progressive boards should frequently consider whether they have the optimum composition. Effective boards are made up of directors who reflect the strategic priorities and challenges of the business, the relevant areas of risk, and the diversity of stakeholders.

Recruiting effective non-executive board members is crucial to ensuring corporate success. The appointment of a non-executive director is not only subject to shareholder approval but to public scrutiny. Boards, and their nomination committees, must be prepared to explain their choices, demonstrate objectivity and lack of bias, and show that appointments are made purely on the basis of merit.

All board appointments must be the result of an objective and rational process, which varies from country to country. Whilst the formal appointment is made by the board and/or the shareholders, the evaluation of candidates usually falls to the nomination committee and sometimes to a committee independent of the company and its executive management.

It is increasingly the case that investors expect non-executive appointments to be mediated through professional advisors. The reasons are various. First, investors expect a transparent and justifiable appointment. Second, objectivity in the choice and how that choice is made is important. Third, bias, real or imagined, is avoided if the process is in the hands of an independent consultant. And fourth, a broader perspective is brought and specialist requirements more easily met.

In some sectors, the regulator has made rules both as to who can be appointed and how they are vetted. This is principally found in the financial services sector, where the financial regulator is responsible for setting the criteria as to the relevant experience of board candidates and for checking their career history and bona fides.

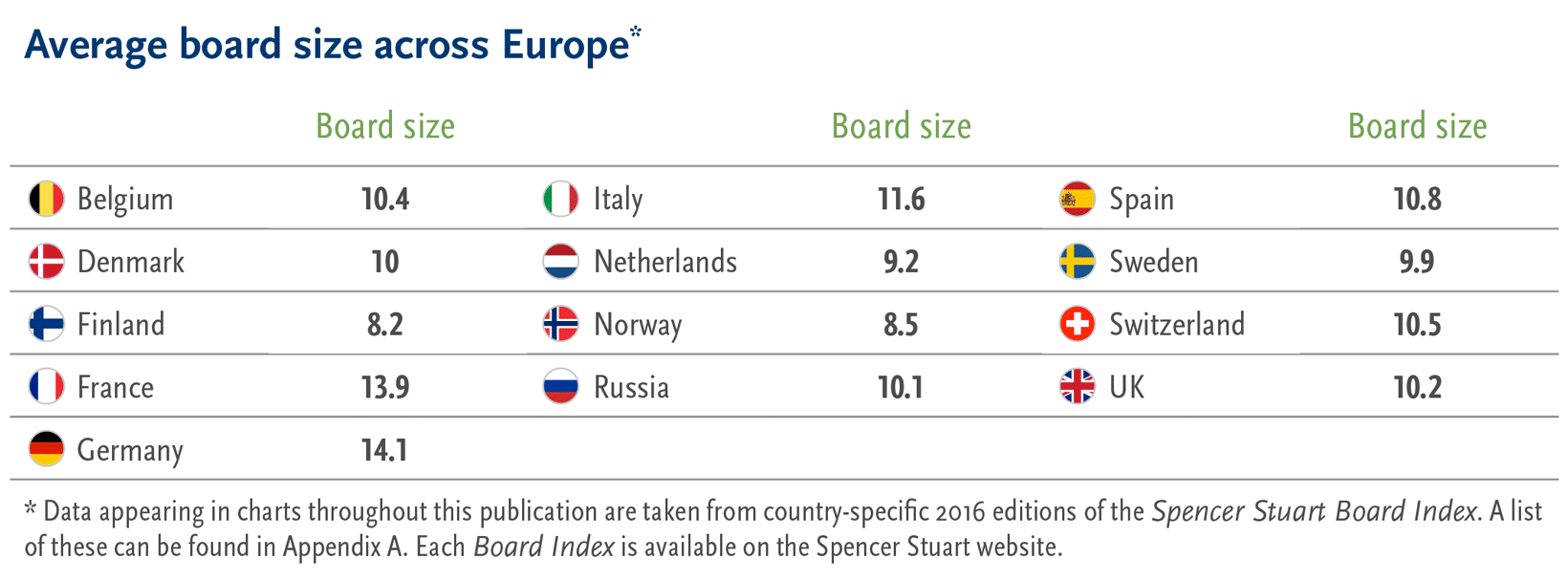

2.2 Board size

The size of a board is critical to its effectiveness. A board needs to be large enough to allow for a wide range of views and competencies and for each of the committees to be populated, but not so large as to prevent active engagement and participation by all directors.

In most instances, we believe that the ideal board size is eight to 12 members in a unitary board. When boards move further into double figures they become less effective: it is harder to sustain effective debate when numerous people are at the table.

Supervisory boards, however, may have to be larger than this, especially where co-determination is a legal requirement. By contrast, supervisory boards with no employee representatives often have fewer than eight directors.

The trend for unitary boards is towards less formal boards with fewer directors around the table. The boardroom is a place for debate and decision — not only for reporting and noting. Each director is expected to make his or her individual contribution.

Just as boards are more accountable for corporate actions, so directors require a closer engagement with the business if they are to carry out their responsibilities properly. The days of the purely reactive board are numbered.

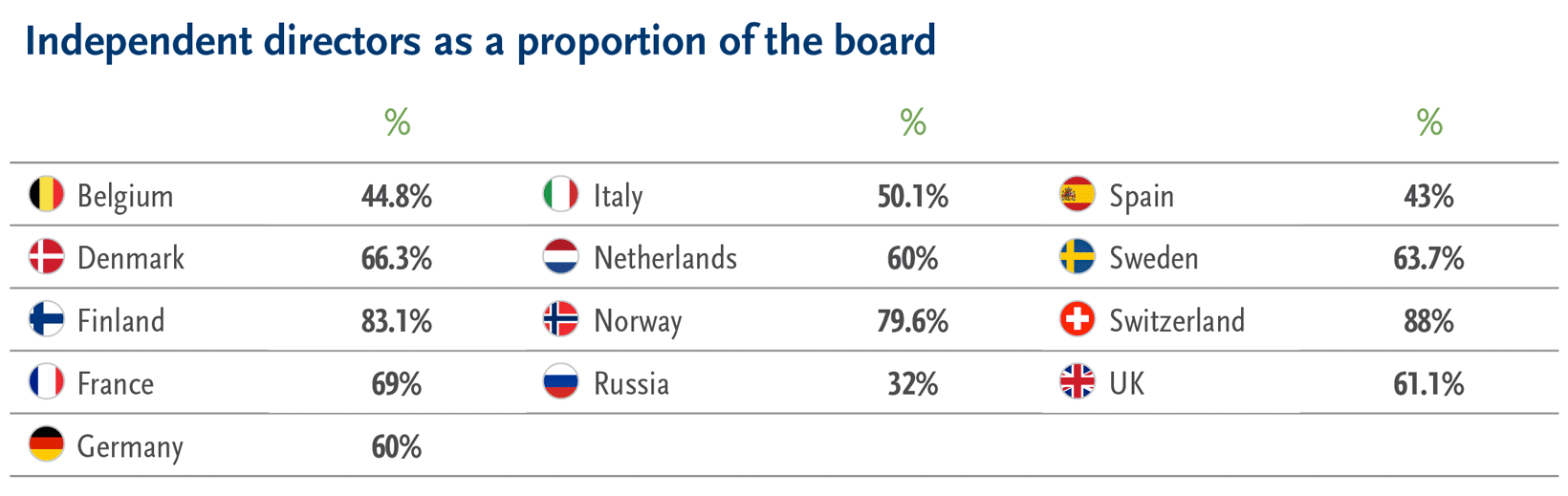

2.3 Independence

Most governance codes recommend that a minimum of 50 per cent of board members should be independent from management and shareholders, with no conflict of interest. In our judgement this is truly a minimum requirement.

Ideally, all outside directors would be independent, but at the very least independent outside directors should comprise a majority of the board.

Independence is defined in various ways, but the following elements are common to most jurisdictions in Europe. Independent directors must:

- be free of commercial or personal conflicts of interest

- not be a former member of the company, at least not before any given cooling-off period

- have no financial relationships with the company or its counterparties

- have no interlocking directorships

- not serve beyond the prescribed number of years.

Obviously, a person’s independent status can change. So it is good practice to review the independence of non-executive directors every year. This is often mandated in governance codes and forms a reporting item in the annual report.

Independence is not only a demonstrable fact but also an attitude of mind.

Independent thinking is essential if the outside director is to act as both challenger and supporter. The best outside directors identify clearly with the business, yet also bring an objectivity to the board’s deliberations that is not possible for the committed executive.

Where there is a controlling stakeholder, or one with a significant holding, the situation can be complex. Such stakeholders can be a founding individual, a government agency, or perhaps an activist or other interloper. Sometimes, in the case of listed companies, the free float can be as little as 25 per cent of the issued equity with the balance held in family or connected hands. Such a situation requires still greater rigour on the part of the outside director to think and act independently.

A simple rule might help in such situations: the truly independent director has the interests of the company and all its stakeholders at heart. What course of action will yield the greatest chance of success for all stakeholders in the longer term?

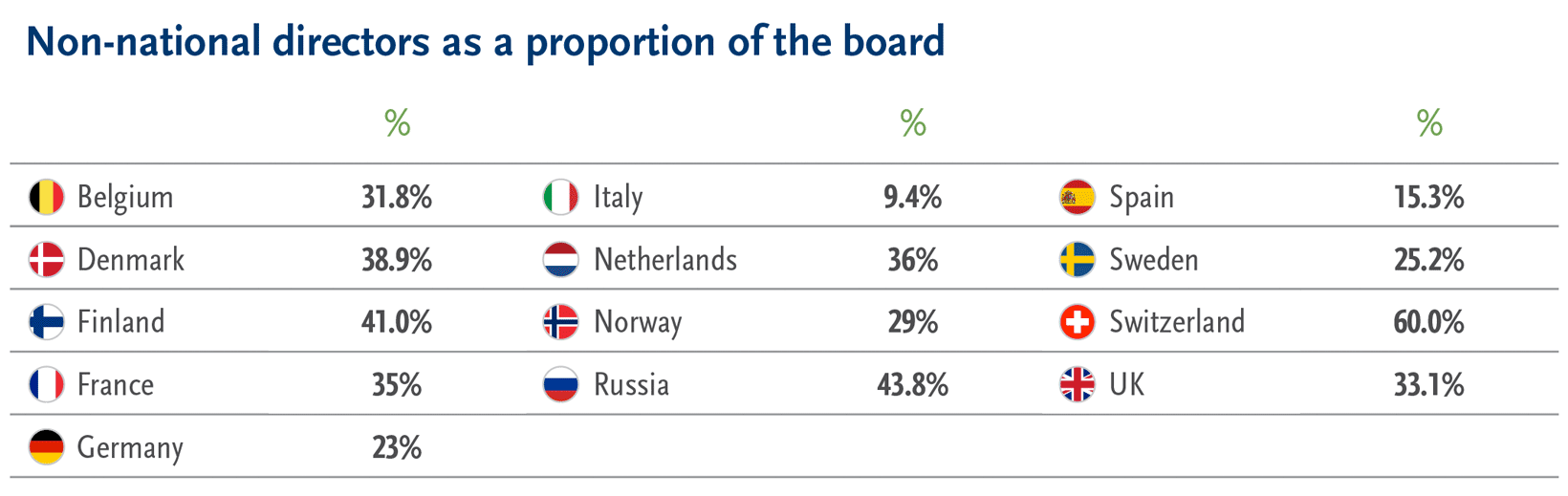

There is currently much discussion around how boards should be constructed. In the past, the pool from which outside directors was chosen was too restrictive and a “club” atmosphere developed in some boardrooms, with extensive interlocking directorships. This risk is now well understood and today’s challenge is to create effective boards that better reflect the world in which companies operate.

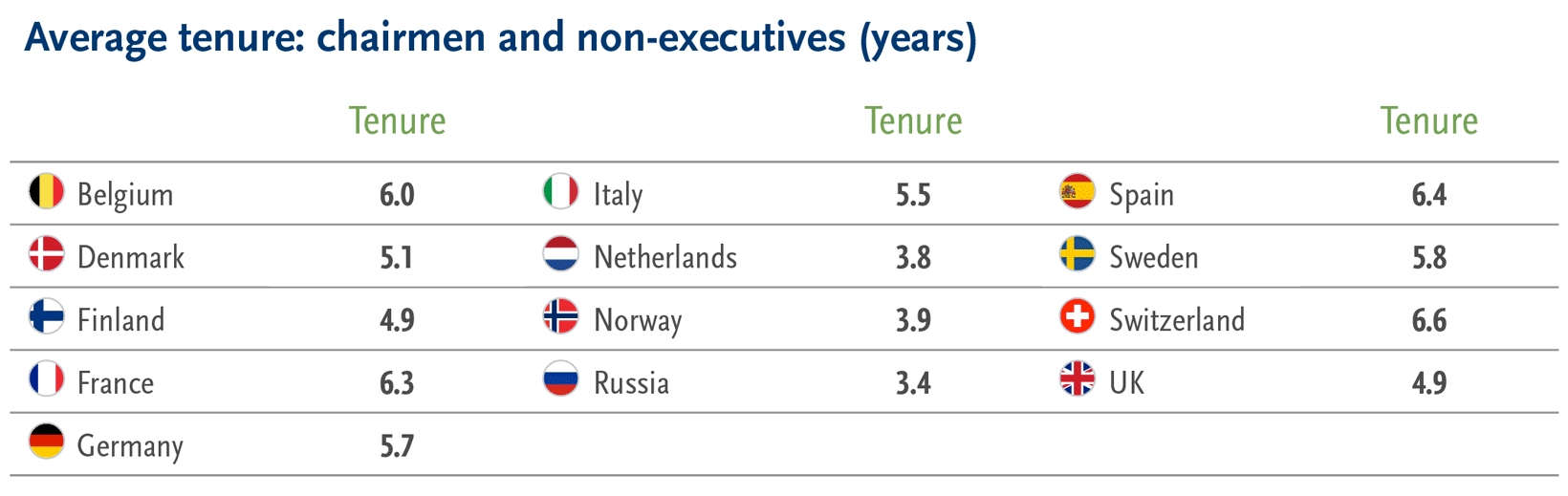

Two initiatives have introduced more dynamism into board composition. First, the adoption of fixed terms has reduced the average tenure of non-executive directors and encouraged board renewal. Second, innovative measures to increase diversity have widened the recruitment pool. We now consider these in further detail.

2.4 Term

Frequency of re-election and length of term for an outside director has, historically, varied according to board structure, preference and local custom.

In recent years, there has been a clear trend towards maximum recommended terms for outside directors and annual — or at the very least, staggered — re-election by shareholders.

These two developments — of maximum terms and regular re-election — are evidence of an increasing democratisation of the corporate governance process, in response to the twin demands of greater transparency and accountability.

The motivation for fixed and maximum terms is to ensure regular infusions of fresh thinking into the boardroom and to avoid complacency. Indeed, it is the fear that independence is jeopardised after a time that has prompted the widespread adoption of term limits.

This raises the possibility of a more dynamic approach to board composition. The need for certain kinds of expertise among outside directors could mean that longevity is no longer the only measure of a director’s success.

A dynamic board should be able to accommodate long-term directors as well as directors who serve only a relatively short term. Certain situations may demand a specific kind of outside contribution where a director is needed for a limited period. An alternative would be for the board to retain an advisor, rather than appoint a director. Such an advisor could attend board meetings by invitation. There should be no harm in a director serving a short term when the reasons for this are understood clearly from the outset. However, too many short-term appointments might become a distraction to the business and could lead to a board in a permanent state of flux.

The appointment and re-election of directors by shareholders is also evolving. Some markets now mandate annual re-election at the AGM for all directors. Originally, it was feared this would lead to instability, that AGMs would become the platform for proxy fights over director appointments and that individuals would allow themselves to be compromised. However, there is no evidence that this has been the case and there is no obvious correlation between the requirement for regular re-election and overall tenure.

For shareholders to fail to re-elect a properly nominated and competent director is very rare indeed — and when it does happen it normally indicates a crisis within the organisation that would have led to instability in any event.

2.5 Diversity

Just as in society, diversity in the boardroom is a sign of health. Diversity can be expressed in many different ways, but in building an effective board what matters most is diverse thinking. Greater diversity leads to better debates and better decision-making, ultimately leading to better results.

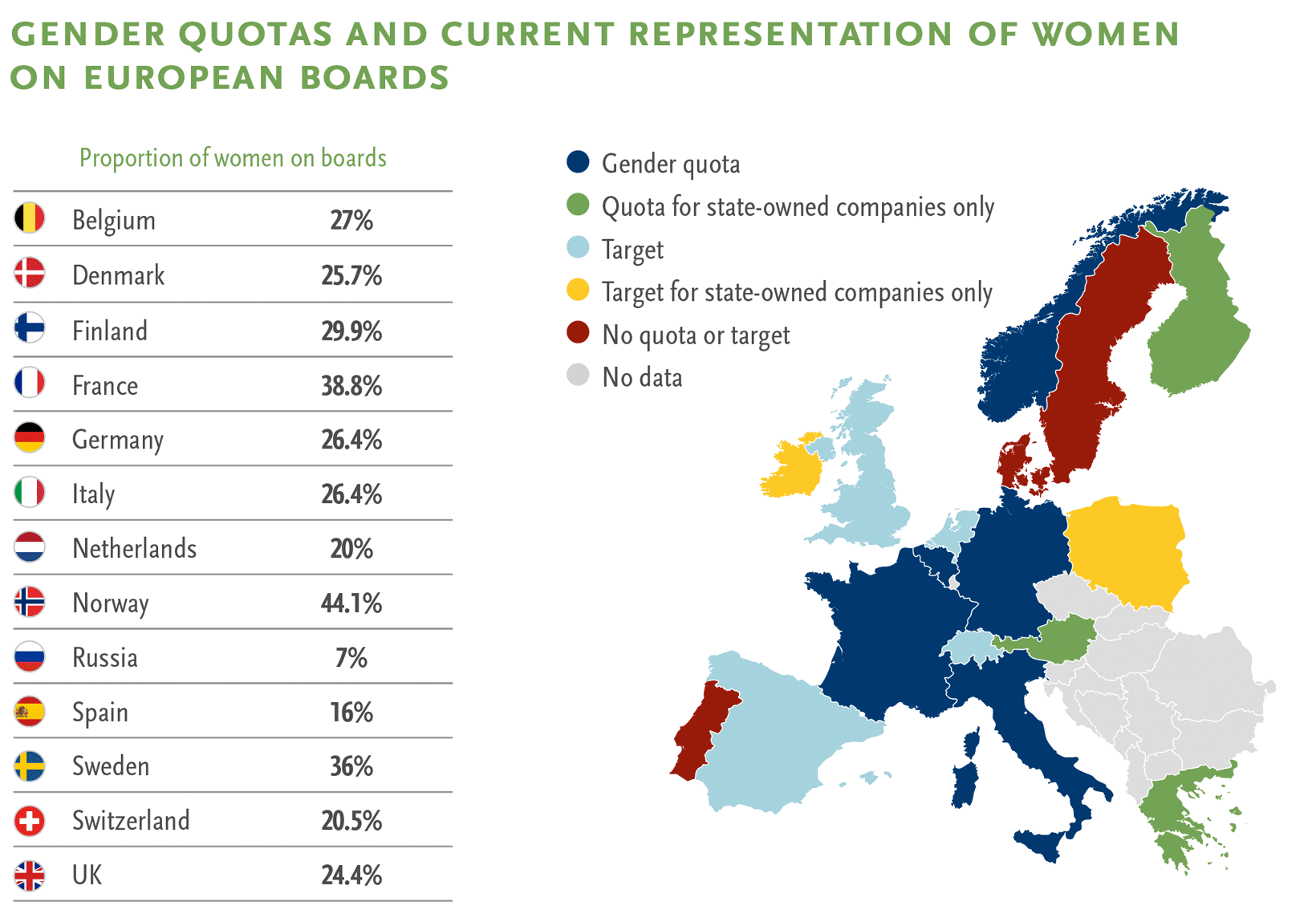

Gender diversity is receiving much public attention and is the subject of both political and regulatory intervention, at national and supranational level. In some countries, ethnic diversity in the boardroom is now emerging as a fresh challenge. The better-led businesses will attempt to act in advance of legislation and indeed many already are doing so.

Regardless of the mechanics used to achieve the result, there is an unstoppable momentum now in favour of greater diversity of thought and experience on boards.

In terms of gender diversity, considerable progress has been made, particularly among outside directors. Progress is much slower among executive directors. To address this will require more than imaginative lists of candidates drawn from wider pools; it will need a re-engineering of corporate HR practices, business priorities and ways of working. Executives with high potential need to be prepared to take on outside board positions. This is a challenge both for the company and for the search professional.

Just as it is reasonable that a board of directors should reflect the gender of society at large, so they should reflect the ethnic mix. A cursory inspection of the boards of Europe’s leading businesses reveals a gulf between board composition and the ethnic makeup of European society or the company’s shareholders.

Behind these assertions lies a much bigger challenge — ensuring true diversity in its widest sense.

True diversity is not simply a matter of physical characteristics. It is about allowing flexibility of thought to prevail over groupthink, bringing to any discussion a variety of experiences, perspectives, interests and expertise.

As in any good team there should be a mixture of styles and strengths on boards. Only by balancing perspectives can true debate and decision be achieved. Thus for every director drawn to the status quo, there must be a challenger; for every deeply experienced member there must be at least one who asks the obvious question; the numerate must be balanced by the literate and so on.

The issue of quotas is at the forefront of the current debate. Certainly, the imposition of quotas for representation on grounds of gender or ethnicity, for example, can help achieve numerical objectives more quickly. But this is not the whole story.

Gender quotas by country

| Quota (target) | | Deadline |

Austria | (35%) | Only companies in which state-ownership is over 50% have to comply. However, the 2012 code of corporate governance recommends that companies report on the measures taken to promote women to the management board, supervisory board and top management positions | 2018 |

Belgium | 33% | One-third of board members have to be “of a different sex from the other members” | 2017 |

Czech Republic | | No targets or quotas | |

Denmark | | The 1,100 largest Danish companies are required by law to define their own target of “the under-represented gender”. They have to report on progress in their annual reports | In force |

Finland | 50% | Only state-owned companies have to comply with the law that states that men and women must be equally represented on a board of elected representatives unless there are special reasons to the contrary | In force |

France | 40% | All listed companies and non-listed companies with at least 500 workers and with revenues over €50 million. If companies do not comply their board elections may be nullified | 2017 |

Germany | 30% | The quota is binding for non-executive positions. In the case of non-compliance, seats allocated to the “underrepresented gender” are counted as as empty. There is also a target for executive directors, although this is not a binding quota. Companies are expected to set their own goals and report on these goals | In force |

Greece | 33% | The quota applies only to the state-appointed portion of full or partially state-owned company boards | In force |

Iceland | 40% | The quota applies to both private and public companies with more than 50 employees | In force |

Ireland | 40% | Only state-owned companies have to comply | In force |

Italy | 33% | The quota is for quoted and state-owned companies that have at least three members on their board. If companies do not comply they will receive a warning followed by fines | In force |

Netherlands | (30%) | Large companies should aim to have at least 30% of their board seats held by women. If they do not reach this percentage they have to explain the reasons in their annual report. There are no sanctions | 2019 |

Norway | 40% | Listed and non-listed public limited companies, state, municipal and co-operative companies | 2007 (ongoing) |

Poland | (30%) | The target applies to publicly listed companies in which the state has shares, or to other key companies | In force |

Portugal | | No targets or quotas | |

Spain | 40% | There is a law recommending 40% female representation, but there are no sanctions | In force |

Sweden | | No targets or quotas | |

Switzerland | (30%) | Women should occupy 30% of board seats and 20% of top management positions. | In force |

UK | (33%) | The target applies to the boards of FTSE 350 companies and to the executive committees and their direct reports for the FTSE 100 only.Companies are asked to develop a strategy to achieve this goal and to report on progress. | 2020 |

European Union | (40%) | The target set by the European Commission refers to the under-represented sex among non-executive directors of companies listed on stock exchanges in member states | 2020 |

2.6 Diversity at the top of the business

Unfortunately, there is still less diversity among chairmen than there is on the boards they lead. This is an important governance challenge for boards to address.

Most chairmen are still recruited from the ranks of former chief executives or chief financial officers. Among larger companies there is an instinctive reaction to appoint only an individual with prior experience as a chairman. But chairmen have to start somewhere.

Given that there is still a bias towards appointing former CEOs as chairmen, the predominantly non-diverse profile of CEOs finds its reflection in the profile of chairmen.

It is clear that far more needs to be done inside organisations to enhance the opportunities for women and ethnic minorities to progress to senior executive roles. Only then can they hope to become plausible candidates for CEO, for non-executive directorships and, ultimately, for the role of chairman elsewhere.

2.7 Commitment

Board members must be able to dedicate enough time to the boards on which they sit, yet the demands on them are becoming more intense and fast-moving.

For an outside director, our experience suggests that 20 to 30 days a year is a reasonable estimate of the time commitment for a public company directorship. Indeed, preparation and reading time, depending on the diligence and efficiency of the director, may add to this. Most chairmen of European companies invest at least twice as much time as other board members.

There may be up to 10 board meetings each year; add to this committee obligations, two or three days away at a strategy meeting and an overseas visit and 20 to 30 days is easily eaten up. And this is before adding additional opportunities to familiarise oneself with the business, attending to any specific tasks and various continuing education obligations.

Inevitably this has consequences for who can plausibly be a candidate for a directorship and who is able to properly discharge the responsibilities.

A sitting executive may find it a challenge to carve out 20 or 30 days from the calendar — even allowing for doing much of the preparatory work at weekends.

Fortunately, most employers see real advantage in permitting their executives to serve on another board. The merits are obvious — it broadens the executive’s experience and understanding, and provides exposure to other ways of doing things. Moreover, the cross-fertilisation this encourages is likely to promote best practice.

However, it is unlikely that a sitting executive could easily cope with more than one, or exceptionally two, outside appointments. Most companies seek at least one or two sitting executives on their boards because their contribution is a reflection of current business practice. CEOs are particularly in demand and can afford to be highly selective.

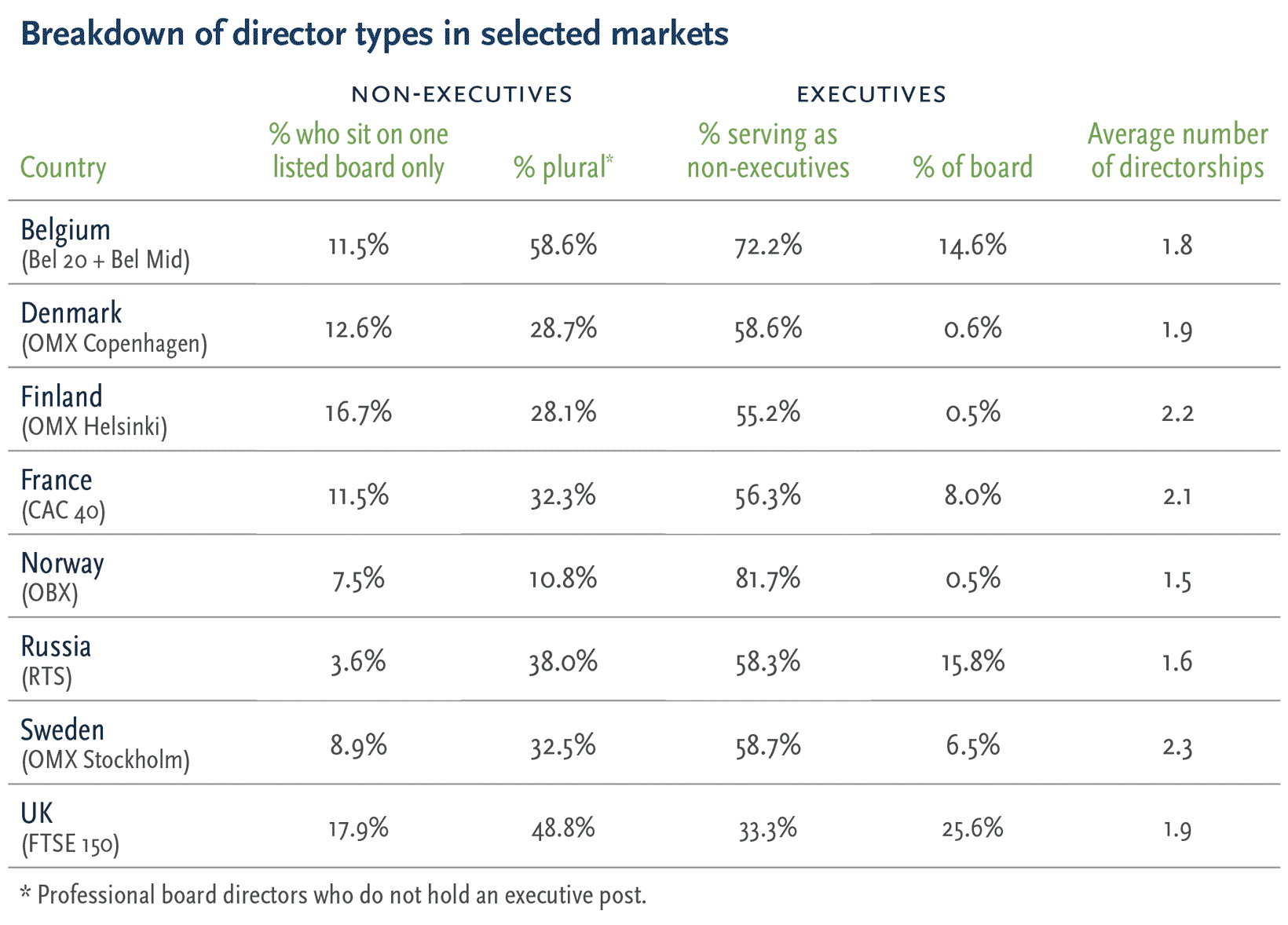

The balance of directors could be taken from the recently retired, for their recent experience, or from the actively “plural”, for their energy and breadth of vision — always leaving room for the “elder statesman” who brings, hopefully, additional perspective and wisdom.

2.8 Number of directorships

As to the maximum number of directorships that a “plural” outside director can contemplate, in previous years one might have said as many as five. However, with today’s level of expectation and commitment, more than three or four listed company directorships is potentially too many. The burden is exacerbated if one or more of the companies fall into crisis. Many directors also have private company, pro bono or not-for-profit positions and the demands of these too can mount up. Nomination committees rarely take account of these commitments, although they should.

Calendar compression is a serious issue. In many markets, corporate year-ends are concentrated around a particular date, for example 31 December. This puts diary pressure on plural directors who have to attend AGMs and accounts approval meetings for example, leaving less time for more reflective contributions.

Board composition can be driven as much by practical considerations as by business needs. For example, it may well be determined by the location and frequency of meetings. International businesses often require regional expertise on the board. However, the practical difficulties of attending a board meeting in Europe for a director based in, say, Hong Kong should not be overlooked. Some organisations have appointed regional advisory boards that avoid the logistical difficulty of having directors flying across continents to board meetings.

2.9 Skills and attributes

Much is demanded of outside directors. For a start, they need to understand the business model and the factors critical to its success.

Traditionally, chairmen preferred to choose people with prior board experience or those already sitting as executive directors. But as boards seek more diversity, the net is being cast more widely. People from advisory backgrounds, the public sector and academia are joining boards, bringing with them very different sets of abilities. In addition, boards are looking closely at other companies’ executives immediately below board level, for example those on the executive team.

The ranks of first-time non-executive directors are swelling as boards seek to correct gender and ethnic imbalance and bring in expertise with specific current skills such as digital, social media or consumer behaviour. Boards are also hiring people with experience of a specific geography. Many of these will rightly be younger appointments.

A summary of the attributes of the ideal outside director might read as follows:

- Commercially aware, financially literate with a good appreciation of risk

- Internationally minded and multilingual

- Interested in the business, committed and well prepared and used to dealing with complexity

- Objective and independently minded, prepared both to challenge and support management yet still a team player

- A relationship-builder and an ambassador

- Intellectually flexible with a sharp mind, able to think laterally and beyond their area of expertise

- Having a particular experience of relevance to the board

- Clear understanding of prevailing governance practice and fiduciary duties

- Fair-minded, having absolute integrity and wisdom and above all courage and common sense

- Articulate and persuasive whilst being a good listener and a good communicator

- And — perhaps most importantly — low in ego yet high in self-confidence.

These are general skills and attributes. Increasingly, boards seek non-executive directors to meet more specific criteria: skill sets, regional experience or other areas of knowledge.

Indeed, this specific “extra” is often the defining feature of what a board looks for in a new non-executive. A board may have identified a need in the context of geographical operation, or knowledge of a specific sector such as financial services, or in an area of risk such as cyber and data security or regulation.

In all of these examples, we believe that the non-executive should not be expected to substitute for a missing executive skill — that must be solved at the executive level. Rather, the expert non-executive director can act as both an informed commentator and interpreter for the rest of the board.

So, an outside director with a relevant skill set can be helpful in translating a particular issue into language understood by a predominantly non-expert board.

However, there are dangers in having a technical “translator” on the board, especially if the dialogue between the director and the relevant company executive excludes other directors. The presence of an expert does not mean that the other outside directors should not seek to master a particular issue: they are not being given permission to switch off from a discussion.

The challenge is that when you bring an individual with deep skills on to the board, they must always be capable of contributing beyond their area of specialism. Particular expertise is optional — but the other attributes of a successful director are mandatory.

Maximum number of mandates

We recommend that boards ask themselves the following questions:

In some jurisdictions the law and corporate governance codes set different limits for the number of mandates that directors may have. The maximum number varies greatly across the region.

Directors of financial services companies are subject to the limits indicated in the EU’s Capital Requirements Directive IV (CRD IV), which states that unless representing a member state, members of the management body of a “significant” financial institution must comply with one of the following: an individual may either have one executive directorship plus two non-executive directorships or four non-executive directorships. Companies within the same group count as separate entities, but not-for-profit or charitable organisations are not included in the restriction.

Belgium

Five listed companies but no further specification.

Denmark

No rule, but the code recommends not taking on more than “a few” non-executive directorships or one chairmanship and one non-executive directorship in companies outside the group.

France

By law, a person may sit on no more than five boards of companies headquartered in France. The corporate governance code limits executives to two outside boards and portfolio directors to five boards, irrespective of whether they are French or foreign.

Germany

The law allows a maximum of 10 mandates, with chairmanship counting double. The code sets a maximum of three mandates for reasons of workload.

Italy

No limit is set for executives. For portfolio directors, each company must set a limit.

Netherlands

A points system operates whereby directors who are Dutch nationals are allowed mandates totalling five points. They may be non-executive director of up to five Dutch companies or organisations, with a chairmanship counting double. Active executives are limited to two non-executive directorships. This applies to companies fulfilling two of the following criteria: at least €35 million revenues; at least 250 employees; €17.5 million assets.

Mandates at non-Dutch companies are not counted in this scheme and neither are cooperatives and some NFP organisations.

Norway

No rules, but in practice, two is generally seen as the maximum for executives and four for a portfolio director.

Spain

No limit is prescribed. Each company sets its own requirements and more than half do have a limit — four is becoming the norm, in line with financial services.

Sweden

None specified.

Switzerland

For listed companies, the code recommends a maximum of five per director, with no distinction between executives and portfolio directors. There are no limits for non-listed companies.

UK

The code recommends that a serving executive should have no more than one FTSE 100 mandate and no chairmanships. In practice, it has become the norm to apply this recommendation to all outside directorships.

Chairmen are expected to chair no more than one FTSE 100 company. There is no prescribed or recommended limit for portfolio directors, but in practice a maximum of four seems appropriate.

2.10 Fit

It is essential that outside directors bring to the board an awareness of the context in which the company operates.

Outside directors are normally appointed for their specific sector, geographic, financial, commercial, marketing or other expertise relevant to the company’s business or perceived needs.

But knowledge and experience are not enough unless they are complemented by a soft skill set. Emotional intelligence is as important in being a successful director as IQ. There is no point in holding an opinion if you can’t put it across constructively and at the right moment.

Collegiality must also join the list of what makes a good fit — but not at the expense of objectivity or courage.

For a potential director to be a good fit the board must see belief in and emotional commitment to the purpose of the business. Most importantly, there should be clear excitement about the challenge.

Keep in mind that a unanimous decision is reached via constructive debate and sometimes by a degree of measured disagreement. So board deliberations must be characterised by trust, openness and mutual respect. This is not to say that sociability is a prime requirement, but boards of directors are both business and social constructs. The most effective outside director is one who is listened to and gaining a hearing is a social skill. Regardless of the skill set, the question for the company is ultimately: will the candidate fit?

2.11 Board culture

As the steward of corporate behaviour, the board’s first obligation is to ensure that its own culture is beyond reproach.

A board’s personality depends on a number of factors, for example the nationality, history, cultural roots and ownership structure of the company. The board’s size, the profile of the directors and the degree of formality in its dealings also play a part in building corporate culture and reputation.

The chairman has a significant role in shaping the style and culture of the board in terms of how relationships are conducted, the quality of teamwork, transparency, communication and freedom of expression among directors, and interaction with the executive team. Every board should therefore consider these matters carefully, for they serve to promote the best interests of the company.

While board behaviours have less influence on culture than those of the CEO and management team, boards do set a tone that in turn has an impact on the company’s culture. Boards should be aware of what that tone is and how they contribute to it by their own actions. They can ask themselves:

- How do our boardroom behaviours advance the right tone at the top?

- Are we sufficiently inquisitive, collaborative, disciplined and decisive?

Remember, we are talking about the spirit and dynamic of the board. This is not necessarily the same thing as the culture of the company. The board is a principal custodian of company culture, but it has a spirit of its own and to some degree this will inform the company’s own culture.