A common rap on chief financial officers is that they are just “numbers people” — light in emotional intelligence, creativity or people skills.

That’s not true of the finance leaders we at Spencer Stuart assess in the course of our executive search and leadership advisory work. Nor is that view borne out in our analysis of the personal style data of more than 1,000 CFOs. The data show that, on the whole, CFOs have a strong inclination toward learning and innovation and relationship-building and collaboration.

Drawn from a data set of tens of thousands of executives around the world, our research includes an in-depth analysis of the personal styles of more than 3,000 C-suite leaders.

The top CFO styles

The three most common styles of the CFOs we analyzed were Results, Caring and Learning. This profile was consistent regardless of industry, company size or type; these same styles prevailed for CFOs of nonprofit organizations, multinational companies, small private companies and across industries. This doesn’t mean that there is a “right” style for a CFO. Indeed, CFOs, like other senior leaders, can vary tremendously in their styles.

Nearly all top executives have Results as one of their top styles. Leaders with a strong results orientation emphasize goal achievement and tend to thrive in outcome-oriented and merit-based cultures where people aspire to achieve top performance. Leaders with a strong Caring style value loyalty and emphasize sincerity, teamwork and positive relationships. The Learning style is characterized by exploration, expansiveness and creativity. Leaders with a strong Learning style tend to emphasize innovation, continuing education and acquiring knowledge.

Some might be surprised that CFOs tend to have a strong orientation toward the Caring and Learning styles. But, in practice, as the CFO role has evolved to become a strategic business leader who serves as a driving force for the commercial performance of the business, the qualities that it takes to get to the top role have changed as well. Getting to the top finance role today requires creativity, comfort with ambiguity, and a desire to learn and engage across the business. It requires an ability to synthesize new information and acquire knowledge and expertise beyond a single technical area. The best CFOs are creative problem solvers; they’re finding ways to get to “yes,” creatively managing spending and capital allocation, and tapping influencing and relationship-building skills.

Our analysis also revealed two potential blind spots for CFOs, especially as generational shifts happen deeper inside finance organizations. CFOs tend to be weaker in the Purpose and Enjoyment styles. If a leader’s style is weak in Purpose, he or she can forget to link the work the team is doing to the broader business goals or the global good, which may make it difficult to connect with a generation of talent that wants to understand how their work fits within a larger context. If Enjoyment is a blind spot, the leader may be so hard-changing and so focused on getting things done that he or she forgets to celebrate achievements and spend time on important team-building activities.

The importance of context: style and culture

The archetypical style is just that: an archetype. In practice, the best style for a leader depends on the outcomes the leader needs to achieve and how the person’s style aligns with the current or target culture of the organization and the culture/dynamics of the team. For example, a CFO with a high Learning and Enjoyment orientation may be a poor fit for a manufacturing company that has a more Order-oriented culture that emphasizes realistic targets and planning ahead. In a multi-unit retailing environment, by contrast, it might behoove a CFO to have a strong orientation toward Caring and Order — as those two styles often predominate in retailers.

An individual’s style profile can be used to understand the environments where the person is likely to feel most engaged and motivated. It also can be used to evaluate how well individuals are likely to align with a company or team culture, including how they may be viewed by others in the organization. When we assess senior leaders, whether for executive search, succession planning, executive development, merger/acquisition integration support or other leadership decision making, we evaluate their style profile.

Here are some of the situations when a CFO’s style tend to be an important consideration.

Hiring and promoting CFOs

One of the most common questions we receive from clients is about how we determine culture fit. The ability to assess a leader’s style and compare it to the culture can enable smarter hiring, reducing tissue rejection in organizations where the culture is a strength or aiding in the selection of new leaders who might serve as change agents where the culture needs to evolve.

For example, we worked with a family business in the alcoholic beverage industry that needed a CFO with strength in financial planning and strategy, who also could help bring more processes to the organization. The company ultimately selected an executive with a more planful orientation (Safety), who also could connect with the culture because his style was high in Results and Caring.

In another situation, the CEO of a healthcare technology company that had grown rapidly through acquisition was in the process of evolving the organization to be more purpose-driven and focused on the success of the company as a whole rather than the success of individual business units. Its culture was characterized by strong Results, Caring and Purpose styles. The CEO selected a CFO who was high in the Results, Learning and Purpose styles, who would be able to help an organization with many long-tenured employees embrace new ideas and drive results.

Style is, of course, just one piece of the puzzle when assessing how a person might perform in a particular role or work within a team or culture. An individual’s capabilities and traits will also influence their ability to thrive or adapt to a specific culture; a person with a lot of emotional intelligence, for example, may have an easier time adjusting to a culture or team that differs from his or her personal style than someone with little emotional intelligence or self-awareness. For this reason, it is important to conduct a multi-method assessment that considers the overall context of the role, including the near-term and long-term critical demands and constraints from the team; individuals’ capabilities and experience relevant to the role; and traits such as their intelligence, judgment, resilience, energy, emotional intelligence, adaptability and potential.

Onboarding

An onboarding program should help new leaders understand how their style does and does not align with the culture — illuminating how their strengths complement the culture of the team and the organization as a whole, and flagging how certain actions could be perceived negatively by others. The mere act of helping a newly hired executive understand the key elements of the culture can make a tremendous difference in his or her ability to be successful.

The CEO/CFO relationship

In most organizations, the CFO is the most trusted adviser to the CEO, so it’s critical that they build an effective partnership. Understanding where their styles align and where they don’t can help avoid misunderstandings and miscommunication by flagging mindsets and behaviors that might be in conflict. If their styles are like oil and water, the CEO and CFO will have to devote time to building a relationship and trust or identify work processes that mitigate the style differences.

The best CFOs are creative problem solvers; they’re finding ways to get to “yes,” creatively managing spending and capital allocation, and tapping influencing and relationship-building skills.

Team dynamics

What are the implications of a team with very similar styles, or with very different styles? CEOs will want to consider the pros and cons of building teams with a greater variety of styles; greater diversity of perspectives and styles can help prevent an echo chamber, but can require the CEO to devote more time to building team-wide trust to be effective. Organizations can improve the effectiveness of their senior teams by helping individuals build self-awareness, teaching them how to get the best out of their colleagues and equipping executives to model the desired cultural characteristics.

Company Culture and Leadership Style: Three Examples

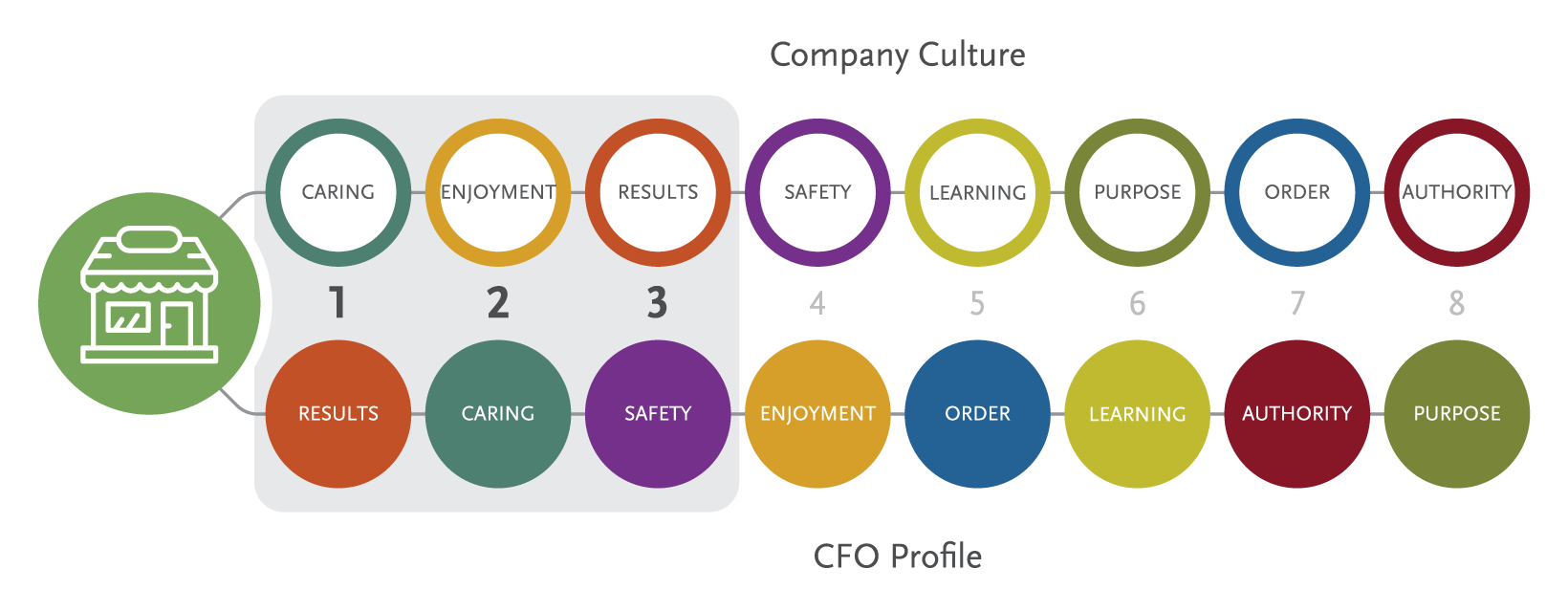

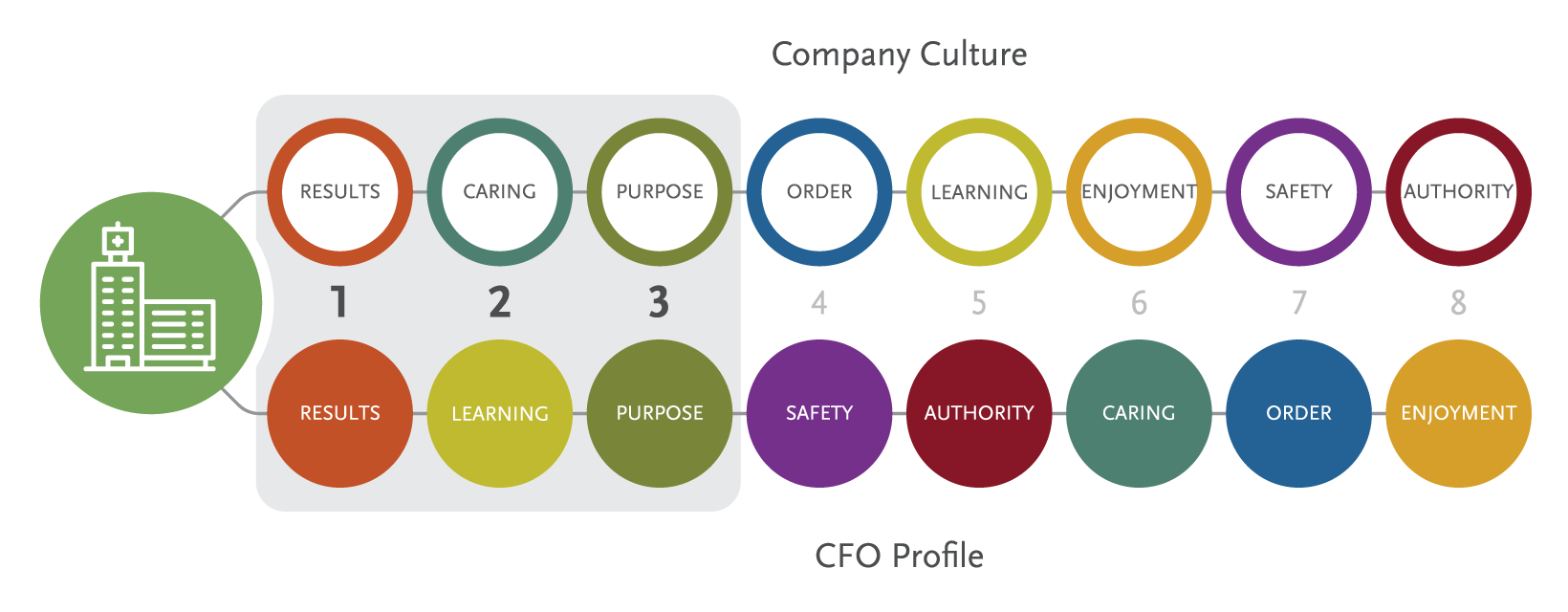

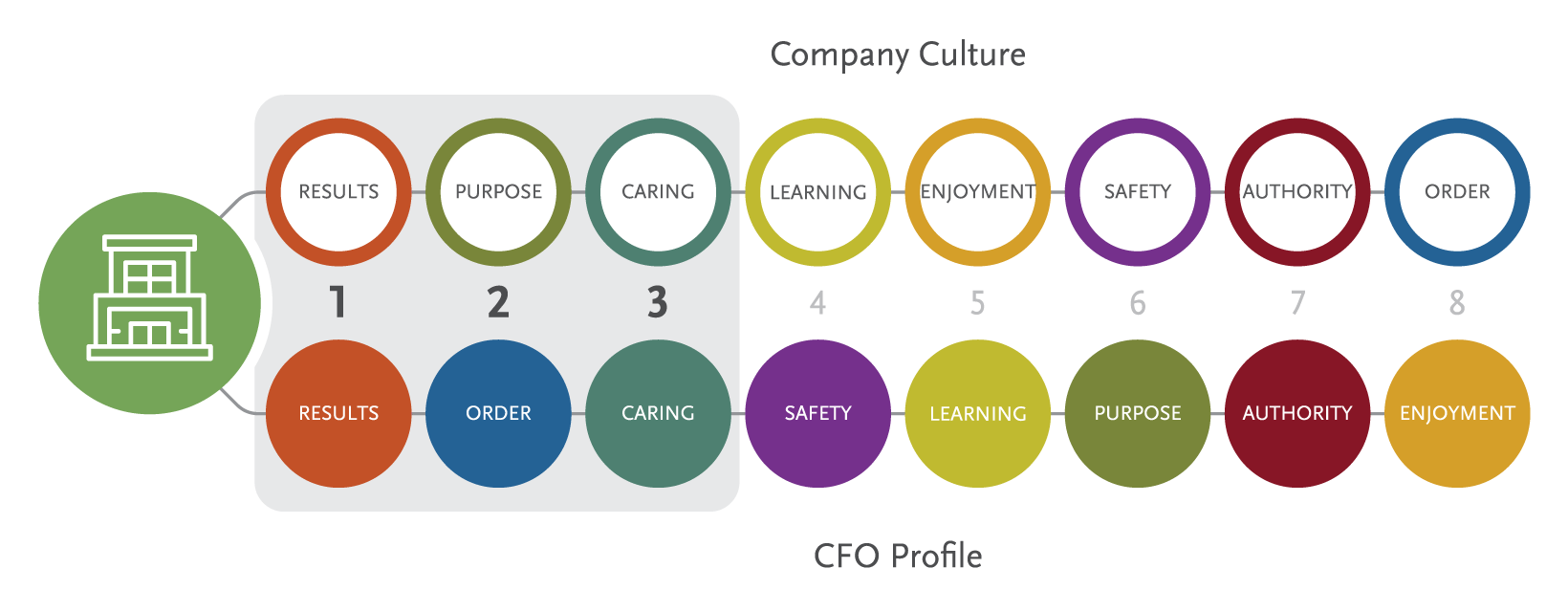

Spencer Stuart’s culture framework uses the same language to describe both organizational culture and the personal styles of individuals, making it easy to evaluate how well the person is likely to align with a company’s current or target culture. A person’s top three styles are the most useful in understanding how the individual is likely to work and interact with others in the culture and their ability to help evolve the culture. A person’s bottom one or two styles can represent blindspots or watch outs for interacting within the culture.

Mid-cap restaurant franchise company

Company was looking for a CFO who could help increase accountability in the organization. High in Safety, the CFO could help the organization increase its focus on planning ahead and setting realistic goals, while also being personable, engaged and relationship-focused to align with the existing culture.

Large-cap healthcare technology company

Company was looking for a CFO who could support the move to a more results-focused and purpose-driven culture. High in Learning, the CFO also could help the organization embrace fresh ideas.

Small family consumer business

Company was looking for a CEO who could help introduce more mature and scalable processes. The new CFO was high in Purpose and Safety, enabling him to connect with and balance out the CEO, a visionary and risk taker.

The CFO style profile

Spencer Stuart has identified eight styles that apply to both organizational cultures and individual leaders. The styles reflect how people and cultures respond across two dimensions: their interactions with people (independence to interdependence) and their response to change (flexibility to stability). A leader’s style profile sheds light on how the person works and relates to other people, and their comfort with change.

To see what we could learn about the styles and preferences of senior financial executives, the Spencer Stuart Financial Officer Practice analyzed the style profiles of more than 1,500 financial executives assessed in 2017, including nearly 700 chief financial officers.

Breakdown of CFOs by company type

| |

Private

|

64%

|

| |

Public

|

25%

|

| |

Nonprofit

|

6%

|

| |

Unknown

|

5%

|

The style profile ranks the person on the presence of the eight styles. The top three styles and the bottom one or two are the most useful in understanding how a person is likely to work and interact with others. The style profile helps illuminate the traits that others value in a person and the kinds of personalities a person may have trouble interacting with.

Leaders emphasize goal accomplishment

Leaders emphasize

sincerity, teamwork and

positive relationships

Leaders emphasize innovation, knowledge and adventure

Leaders emphasize being realistic and planning ahead

Leaders emphasize shared procedures and time-honored customs

Leaders emphasize confidence and dominance

Leaders emphasize spontaneity and a sense of humor

Leaders emphasize shared ideals and contributing to a greater cause